Terug naar het overzicht

Enhancing Pension Fund Management with Dual Classification System

Enhancing Pension Fund Management with Dual Classification System

In today's evolving financial landscape, pension funds are increasingly adopting a dual classification approach for their portfolios. This practice involves dividing pension portfolios into two primary classes: Matching and Return. Recognizing this trend, our portfolio administration system has integrated these classifications, offering greater flexibility in categorizing individual securities as part of either the Matching or Return portfolio. This innovative system complements traditional asset categories such as equities, bonds, and alternatives, providing a more nuanced and efficient portfolio management strategy.

You might wonder, is this practice common across all systems? The answer is not quite. Our approach introduces a significant difference: we employ a dual classification system both at the security level and the pool level, rather than requiring a split Matching and Return portfolio from a custody perspective. This means that individual securities can be classified under Matching or Return without the need for a rigid and inflexible portfolio setup.

This dual classification attribute offers several advantages:

Integration Across the Value Chain

Our system has fully integrated this Matching/Return classification throughout the value chain, including:

As a general rule, the grouped benchmark is based on all benchmarks that are included in the allocation at this stage and are defined at the reference (e.g., security) level. The asset quotas of the investments at the beginning of each month are always used as weights for the composition. Within a month, the daily asset quotas are calculated based on the performance values of the benchmark, which are, if chosen, available for almost every day over time. Rebalancing then takes place at the beginning of the next month. This results in a sequential, grouped (composite) benchmark calculated ad hoc from individual benchmarks. This bottom-up approach delivers the right results when using the dual classification system and allows for thorough performance analyses from every angle.

Conclusion

The implementation of a dual classification system in pension fund management marks a significant advancement in portfolio administration. By classifying securities at the security level into Matching and Return portfolios, we provide unparalleled flexibility, ease of reporting, and compliance with regulatory requirements. This innovative approach ensures that pension funds can manage their portfolios more effectively, respond to market changes dynamically, and meet the rigorous demands of performance reporting. Our commitment to integrating this classification throughout our reporting and investment management systems underscores our dedication to providing clients with the tools they need for superior portfolio management.

In today's evolving financial landscape, pension funds are increasingly adopting a dual classification approach for their portfolios. This practice involves dividing pension portfolios into two primary classes: Matching and Return. Recognizing this trend, our portfolio administration system has integrated these classifications, offering greater flexibility in categorizing individual securities as part of either the Matching or Return portfolio. This innovative system complements traditional asset categories such as equities, bonds, and alternatives, providing a more nuanced and efficient portfolio management strategy.

You might wonder, is this practice common across all systems? The answer is not quite. Our approach introduces a significant difference: we employ a dual classification system both at the security level and the pool level, rather than requiring a split Matching and Return portfolio from a custody perspective. This means that individual securities can be classified under Matching or Return without the need for a rigid and inflexible portfolio setup.

This dual classification attribute offers several advantages:

- Flexibility in Reporting: It allows the generation of Matching and Return performance and NAV reports without needing a fixed portfolio structure. This flexibility is crucial for accurate and comprehensive performance monitoring.

- Ease of Transfers: It facilitates the transfer of a single security from the Return to the Matching portfolio, with or without retaining its historical performance. This capability is vital for dynamic portfolio management and strategic adjustments.

- Compliance and Monitoring: The dual classification property enhances our ability to comply with information requests from pension administrators (Pensioen Uitvoering Organisatie) for their reporting obligations. This includes splitting performance accurately across different classifications.

- Simplifying Reconciliation and Reporting: By incorporating this classification into the portfolio administration, reconciliation with required performance splits in the WTB-report template structure becomes seamless.

Integration Across the Value Chain

Our system has fully integrated this Matching/Return classification throughout the value chain, including:

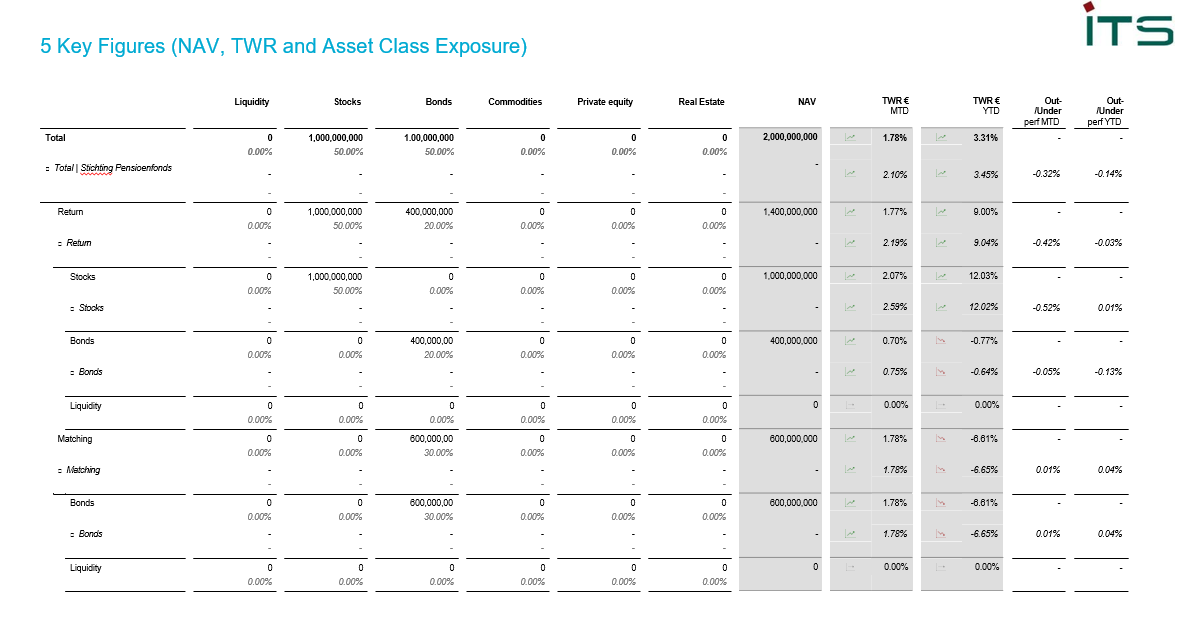

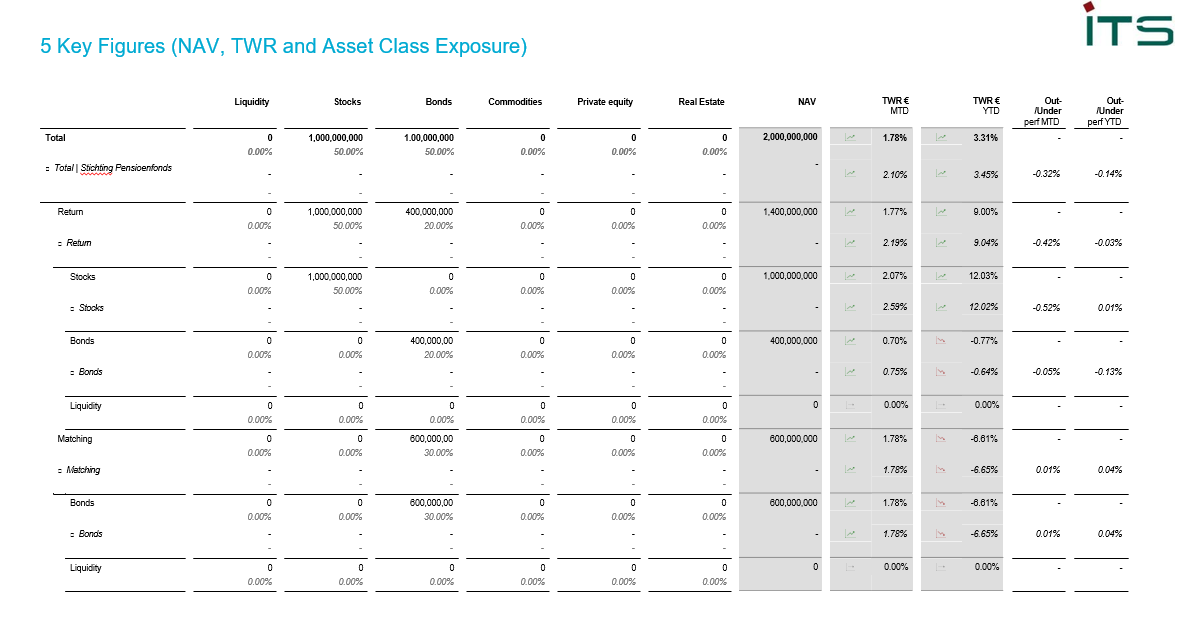

- Monthly Reporting Packages: Clients receive detailed reports that reflect the dual classification, ensuring clear and precise performance tracking.

- Investment Portal: The classification is incorporated into our investment portal, providing clients with real-time access to their portfolio performance and classification details.

As a general rule, the grouped benchmark is based on all benchmarks that are included in the allocation at this stage and are defined at the reference (e.g., security) level. The asset quotas of the investments at the beginning of each month are always used as weights for the composition. Within a month, the daily asset quotas are calculated based on the performance values of the benchmark, which are, if chosen, available for almost every day over time. Rebalancing then takes place at the beginning of the next month. This results in a sequential, grouped (composite) benchmark calculated ad hoc from individual benchmarks. This bottom-up approach delivers the right results when using the dual classification system and allows for thorough performance analyses from every angle.

Conclusion

The implementation of a dual classification system in pension fund management marks a significant advancement in portfolio administration. By classifying securities at the security level into Matching and Return portfolios, we provide unparalleled flexibility, ease of reporting, and compliance with regulatory requirements. This innovative approach ensures that pension funds can manage their portfolios more effectively, respond to market changes dynamically, and meet the rigorous demands of performance reporting. Our commitment to integrating this classification throughout our reporting and investment management systems underscores our dedication to providing clients with the tools they need for superior portfolio management.